Direct Store Delivery Versus Centralized Distribution

Direct Store Delivery DSD Versus Centralized Distribution

The North American retail distribution supply chain landscape continues to evolve in response to unprecedented pressure to reduce operating expenses. The primary cause of turmoil in the retail sector is of course due to the unbelievable growth that Walmart has experienced over the past five decades which has quite literally decimated many companies that maintained a “business as usual” strategy.

Without doubt, the dominant trend in retail distribution in recent decades has been the dramatic increase in the retailers’ control of the supply chain. North American retailers have been executing on a variety of strategies to increase inventory turns and to reduce operating expenses. In the food industry, one of the important trends that retailers and branded food producers have leveraged is the concept of Direct Store Delivery (DSD).

Direct Store Delivery Overview

Direct store delivery (DSD) is the term used to describe a method of delivering product from a supplier/distributor directly to a retail store, thereby bypassing a retailer’s distribution center. DSD products are typically, but not always, fast-turning, high velocity, and high consumer demand merchandise.

In 2008, the Grocery Manufacturers Association (GMA) reported that DSD represents 24 percent of unit sales and 52 percent of retail profits in the grocery channel. In the Grocery industry, DSD has been an important channel for many decades for some branded food producers. For these companies, DSD improves sales performance because there is much greater control over retail shelf space. Powerful vendors using DSD as a sales channel include Coca-Cola, PepsiCo, Kraft Foods, Frito-Lay and Sara Lee amongst others. These vendors often provide a variety of value added services as part of their DSD offering with the aim to improve sales and margins for the retailer, including:

Shelf Inventory Management

In-store Forecasting

Store Level Authorized Item Management

Price and Promotion Execution

Store Ordering

In-store Merchandising

Since the 1980s and concurrent with the explosion of Walmart SuperCenters across the United States, increased competition has forced retailers to renew their focus on taking out inventory carrying costs from their supply chain. A new era of ”just in time” and “lean inventory” emerged as the new school of thought, with industry pundits pointing overseas to European retailers as prime examples of success. Concurrent with the drive to increase inventory turns, DSD was touted as an important engine to increase sales growth. The benefits of DSD to the retailer have been reported as follows:

Increased sales because knowledgeable supplier representatives of DSD products are in the stores multiple times per week merchandising their products. Out of stocks for DSD items are reported as being 2 - 4% less than products distributed through retail distribution centers.

Thousands of retailer hours saved due to a reduction in shelf-tag & scan errors because DSD item data is managed by vendors and communicated to retailers through data synchronization.

Reduced labor expense for reordering and merchandising products since this is taken care of by the supplier at no extra cost to the retailer. Merchandising time spent handling item data is reduced by 5 - 10%.

DSD products bypass the retail distribution center which takes out 0.5 - 1.0% inventory out of the retail distributor’s inventory assets.

Thousands of hours of retail warehouse labor hours saved because DSD products are delivered directly to the stores. Logistics costs savings to the retailer are estimated at a 1.0%+ reduction.

Speed to market for new items is improved by 2 weeks because products bypass retail distribution centers in the supply chain.

A 5 - 10% reduction in finance time and audit fees spent reconciling invoices.

There are some companies whose entire success is predicated on maintaining a strong control over their DSD network because it is the means by which they can generate and increase sales revenue and throughput volume. One example of a highly successful DSD distributor is Goya Foods based in Secaucas, NJ. Goya is a leader in the Latin American food industry which is considered to be a specialty food category. The company operates 11 distribution centers in the United States which service over 2,200 SKUs primarily through the DSD channel. Many smaller Latin American food shops order directly from Goya and receive next day service through Goya’s regional DSD network. The DSD network has a strong fit in this context because of the fact that much of the product is sold to smaller retail stores. Goya does sell product to major retailers and oddly enough this is a mixed bag of orders shipped directly to stores and retail distribution centers

With all of these incredible benefits to the retailer, what could possibly be the downside of DSD?

Direct Store Delivery versus Centralized Distribution Networks

A centralized distribution network describes the flow of goods from the manufacturer’s distribution network through to the retailer/wholesaler distribution networks whereby the retailer/wholesaler then distributes the merchandise to the retail stores. A DSD network bypasses the retailer/wholesaler distribution network with goods moving directly from the point of production/distribution to the stores.

DSD networks are generally either 2-tier or 3-tier in their configuration as per the two schematics shown below: In the 2-tier grocery distribution network, products are typically distributed by the branded food producer to the retail stores through a network of distribution centers and smaller branch warehouse locations that are regionally positioned close to the point of consumption. The 3-tier distribution network is similar except that the food producer has typically outsourced the logistics function to a third party that has an established infrastructure capable of servicing the market. In the 3-tier distribution network model, the distributor may either be a full service provider or a “case dropper” whereby the former category performs both the logistical function in addition to the merchandising function.

In the 2-tier grocery distribution network, products are typically distributed by the branded food producer to the retail stores through a network of distribution centers and smaller branch warehouse locations that are regionally positioned close to the point of consumption. The 3-tier distribution network is similar except that the food producer has typically outsourced the logistics function to a third party that has an established infrastructure capable of servicing the market. In the 3-tier distribution network model, the distributor may either be a full service provider or a “case dropper” whereby the former category performs both the logistical function in addition to the merchandising function.

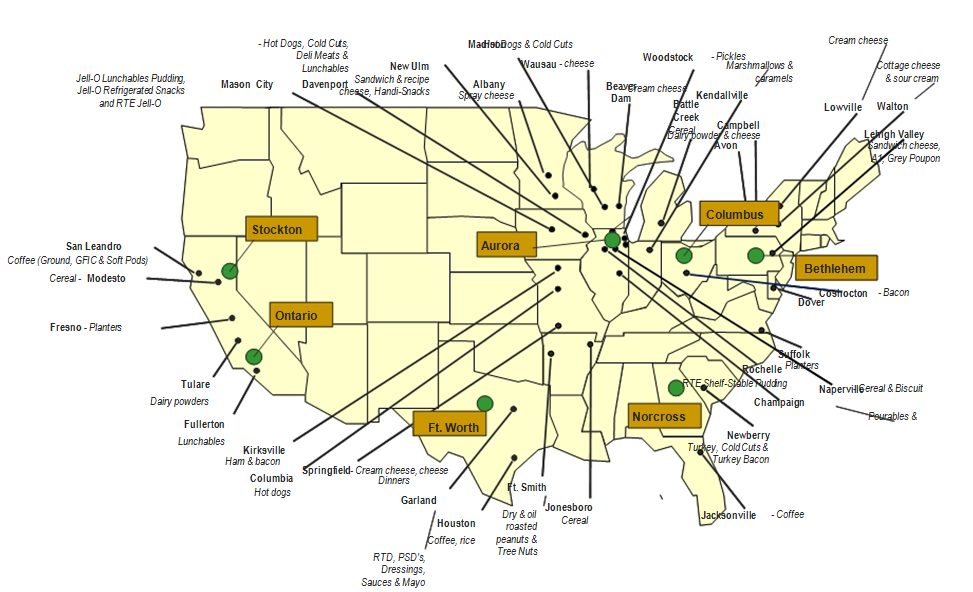

For illustration purposes, Kraft Foods provides an interesting portrait of a company that supports both a traditional centralized distribution network as well as a 2-tier DSD distribution network. A map of the mainland USA Kraft production and distribution network is shown below.

Source: Kraft Foods & Lehigh University Center for Value Chain Research

Source: Kraft Foods & Lehigh University Center for Value Chain Research

Kraft produces food merchandise at dry, refrigerated and frozen Kraft plants and/or third party manufacturers positioned across the country. From the plants, goods may sometimes require transfer to re-packers. Finished goods are then shipped from the plants to a network of upstream Kraft buffer facilities which act as storage overflow buffers positioned close to the plants. Merchandise is then pulled by a network of regional mixing centers that are strategically positioned closest to major U.S. concentrated demand centers. A Kraft mixing center is typically a large multi-temperature regional distribution center that services retail and wholesale distribution centers within its trading area (see brown boxes above). The mixing center network services in the neighborhood of 4,900 customer distribution centers across America. From the customer distribution centers, product is then moved through retailer or wholesaler distributors to the retail stores. This network provides the hub and spoke backbone for the centralized distribution network which services the majority of Kraft food merchandise across America.

In addition to the above centralized distribution network, Kraft operates a 2-tier DSD distribution network for its Nabisco Biscuit Division (In 2000, Philip Morris Companies, Inc. acquired Nabisco and merged it with Kraft Foods). Nabisco products are produced at a 1.8 Million Sq. Ft. production facility in Chicago and they are then stored in a buffer facility in Morris, IL. Morris supplies approximately 100 dry DSD branch warehouse locations across the country. These branch locations provide local deliveries with peddle runs (e.g. 8 - 10 stops/load) to approximately 51,000 retail customer locations. Local Kraft representatives then provide the in-store value added merchandising services. For its frozen merchandise, the process is similar except that a distribution network of 245 frozen branch warehouse locations is in place to service frozen foods. frozen pizzas, etc. to a similar customer base.

What is interesting about this portrait is that a box of Ritz crackers flows through the centralized Kraft distribution network but a box of Nabisco Triscuit crackers flows through the Kraft 2-tier DSD distribution network. These are similar products in terms of their physical characteristics so it cannot be argued that highly fragile or crushable merchandise should flow through DSD channels to reduce touch points in the network to minimize product loss due to damage. In truth, the reason that these products have very different supply chains is quite simply historical as Nabisco (and its DSD supply chain) was acquired by Kraft’s parent company Philip Morris.

Does it make economic sense for Kraft Foods to operate a separate infrastructure of 100 warehouse branch locations with a separate fleet of trucks to perform highly expensive customer deliveries to 51,000 stores for a single division of the company? Does it make sense that this distribution network exists in addition to a highly efficient distribution network of 7 regional mixing centers that already service grocery stores through existing retail and wholesale distribution networks? Does it make economic sense that high price retail merchandising labor is then deployed in the field to service retail store shelves that are already being stocked and merchandised by local store resources for all non-DSD products? These are interesting questions indeed because they expose one of the most important final frontiers of efficiency opportunities in the U.S. food supply chain. These questions expose the unspoken truth that the DSD channel is a very expensive supply chain for moving many food products to market.

Centralized Distribution

Spend time studying the supply chains of any underdeveloped country that has a population base spread across a large land mass and one very quickly gains an appreciation of the economic benefits to consumers due to centralized distribution. These countries desperately need centralized distribution networks to lower food costs to consumers. The United States arguably has the lowest cost of food in the world because of the efficiencies of centralized distribution. Imagine for a moment if every food production plant in the country were to deliver food products to every retail store in the country - this is how it works in many developing countries. Without centralized distribution, there simply are no economies of scale and the variety of products on the retail shelf is reduced dramatically. For the same reason that a centralized hub and spoke distribution network is a fundamental enabler to our highly efficient global parcel delivery system, a centralized distribution system is also the fundamental enabler for the efficient distribution of most consumer products. Having said this, here are some good examples of when DSD makes perfectly good sense as an efficient channel by which to move goods to market:

Full truckload shipments ordered directly from the manufacturer by a retail store. In this scenario, there is no value to having a full truckload shipped from the plant to the retail distribution center and then on to the retail store. Bypassing the retail distribution center is the most efficient flow path for this merchandise from the point of production to the retail store shelf.

Product lines such as potato chips and fresh bread that are low value-density (i.e. low dollar value and high cube) and that can be easily damaged if they are handled through too many touch points. For most chip manufacturers, poor shelf presentation leads to decreased sales hence they have invested into the infrastructure to support DSD sales networks. Having said this, as the cost of transportation increases, there is growing momentum and pressure to move snacks through centralized retailer/wholesaler distribution networks.

Product lines with very low shelf life / critical freshness requirements such as fresh milk and eggs are often supplied through DSD channels to minimize the duration of time that the product spends within the supply chain. Having said this, a number of grocery retailers centrally produce and/or distribute private label fresh milk as an alternative to the DSD system. Ice cream often moves through DSD channels direct to grocery stores as many retailers do not have the ability to warehouse and distribute product that is held at colder temperatures required for these product lines.

Product lines that are costly to transport and that are distributed from points close to high volume store locations. Heavy products that generate high transportation expense are good candidates to bypass retail distribution networks for high volume stores - when there is a reduction in total logistics expense to move the goods to the retail shelf. Bottled water ordered in large quantities is a product line that serves as a good example for this scenario.

Suppliers with a high variety of low value merchandise that can easily be shipped from point of production to the retail stores in small parcels. A good example of this is greeting cards. A retail store may have 10,000 greeting cards on the store shelf therefore the most efficient supply chain is to have the cards shipped to the store by small parcel whereby a local card company representative can then merchandise the product at the store. This product line is simply too time consuming for the retailer to manage due to the high assortment of low value merchandise.

Product lines with high complexity that require knowledge that only a supplier representative can provide. Picture a retailer that sells an assortment of fishing lures specifically for the outdoor fisherman. The vast variety of fishing lures and the type of fishing lures that are stocked at each retail store are dependent on the type of fish to be found in the lakes nearby to each store. The supplier of the lures manages the logistical DSD function, but more importantly, the supplier also provides the value added merchandising service to identify which fishing lures to stock in each store.

Product lines that require specific types of storage or handling that cannot easily be provided by the retailer or wholesaler distribution network. Some products are simply too difficult for retail distribution networks to handle because of the physical attributes or storage requirements of the product itself. Apparel and footwear is often rightfully shipped to retail stores using vendor managed inventory systems whereby goods are ticketed and prepared by the producer and then shipped directly to the store via small parcel. Other products such as ladders may not be conducive to standard warehousing and trucking systems that are designed to efficiently handle high volume standardized “brown box” types of merchandise.

There are other examples of when DSD channels make good sense as a primary channel of distribution. However, for many fast moving consumer goods and specialty foods markets, the use of DSD as a primary channel to move goods to market is highly inefficient and remains an opportunity that may eventually be attacked when high power retailers begin to understand the hidden costs of DSD distribution. Some retailers have already made strong progress in this area.

Retailers Switching From Away DSD Channels to Centralized Distribution

As mentioned earlier, Walmart changed the competitive retail landscape forever beginning in the 1980s with the opening of SuperCenters across America. Between 1990 and 2000, Walmart opened 7 new SuperCenters every month and by the end of 2000, 888 SuperCenters were open for business. By 2002, Walmart had become the world’s largest retailer with annual sales of $218 Billion. Walmart reportedly moves 85% of its cost of goods through its own network of 147 highly efficient retail distribution centers across the U.S. which is well above its competitors that are closer to 50%.

In February, 2006, about 55 Coke bottlers sued Coca-Cola Company and Coca-Cola Enterprises, alleging that Coke/CCE’s test of Powerade warehouse deliveries to a Walmart distribution center in Texas (with plans for a national rollout for April, 2006) breached the bottlers’ Powerade contracts. The bottlers maintain that the DSD system is at the core of the successful marketing of Coke’s products. Coca Cola defends its actions by the fact that Walmart approached them with the proposal to test moving Powerade through Walmart’s distribution centers. Furthermore, the Coca-Cola Company later revealed that Walmart may have been willing to produce its own sports drink under a private label if Powerade distribution was not switched from smaller bottlers to warehouse delivery. This incident begs the question as to why Walmart made the move to shift Powerade from the DSD channel to centralized warehouse distribution in the first place.

Beginning in 1998, OfficeMax replaced a distribution system that relied on over 1,000 DSD vendors to provide direct store deliveries of all products to nearly 1000 retail stores across America - with a centralized network of super-regional distribution centers called PowerMax facilities. The company invested $135 Million to construct three 600,000 sq. ft. distribution centers in McCalla, Alabama; Hazleton, PA; and Las Vegas, Nevada. The new distribution centers reportedly eliminated over $400 Million of backroom inventory from the stores by shifting 95% of the cost of goods away from the DSD channel to the company’s own centralized distribution network.

The Sports Authority is a full-line sporting goods retailer with over 200 stores that feature up to 45,000 items supplied by approximately 850 vendors. The Sports Authority had been relying on a 100% Direct Store Delivery (DSD) system with no warehouses or distribution centers. The company ultimately made a major shift from its DSD strategy to a flow-through, regional distribution center network. In late 1997, The Sports Authority completed its first 300,000 sq. ft. distribution center in McDonough, GA which ships over 1 Million units per week to 150 stores along the East Coast. The move reduced overall logistics and retail labor expense and concurrently improved customer service levels.

Speaking at a beverage conference in May, 2008 and later in an extensive interview for Convenience Store News in July, 2008, 7-Eleven CEO Joe DePinto called DSD a "fragmented and inefficient" system that clogs convenience stores with as many as 50 to 60 deliveries per week. "The current supply chain is archaic and complicated," he said. "It takes store operators' attention away from serving the customer." This is not just a concern for 7-Eleven, but for the entire convenience store industry. His suggested solution: combining what are now DSD products, such as beer and soft drinks, in a distribution center and delivering them together on the same truck. 7-Eleven stated that is planning to test such a system in southern California. The company has since successfully consolidated its fresh foods delivery system and is using the same approach with other major product categories by reducing the number of deliveries each store gets and the number of vendors delivering to each store.

In 2007, Home Depot announced an ambitious plan to transform its supply chain. At the core of the strategy is a program to shift its current mix of 60% cost of goods through DSD channels and 40% through its own distribution network - to a 25% DSD and 75% self-distribution model. The plan calls for a capital investment of $260 Million to be invested into new regional distribution centers (RDCs) across the country. When the dust is settled, the company expects to have a centralized distribution network of RDCs with the typical facility being 657,000 sq. ft. providing service to about 100 retail stores. One of the main drivers to the channel switch away from DSD was a deteriorating company-wide inventory performance where annual turns had reduced from 5.4 to 4.25 between 1998 and 2007. The new centralized distribution model is expected to improve inventory by 1 full turn generating a $1.5 Billion reduction of working capital invested in inventory.

Before the Home Depot transition, Lowes made the strategic move towards increased centralized distribution. Lowes stores stock an average variety of 40,000 SKUs. In 2008, the company operated 14 regional distribution centers (RDCs) for cartonized goods, 15 flatbed distribution centers (FDCs) for building commodities, and 7 Import distribution centers for import transloads and holding.

o Lowes basically uses a direct store delivery strategy when the store frequently sells a vendor full truckload shipment, or the vendor shipment point is close to the store. This is because DSD provides the lowest flow cost by bypassing the Lowes distribution center network. In these cases, DSD reduces overall inventory and freight costs to move the goods to the store. Typical products that fall into this category would be things like drywall, plywood, cement mixes, etc.

o Lowes centrally distributes most products sold by their stores quite simply because this enables the most cost effective supply chain for the majority of its merchandise. The savings generated by centralized distribution are: more efficient freight moves inbound & outbound, risk pooling to minimize safety stock; delayed allocation because stores have a shorter order lead time; improved store service levels due to better fill rates; and vendor efficiencies due to less deliveries). For example, outbound cubic feet of merchandise per load increased from 2,253 to 2,503 (an 11% gain) after the company shifted more volume through its own centralized distribution network.

o The trade-offs are higher distribution center operating expenses such as labor and the need for more warehouse space; and the addition of inventory assets at the distribution center. In the end, the benefits of centralized distribution outweigh the trade-offs for the majority of SKUs.

Conclusions

This article serves to address the controversial topic of direct store delivery versus centralized distribution. Clearly, the pendulum of power has been swinging towards the retailer over the past two decades. As Walmart and other “big box” retailers strive to reduce inventory assets and overall logistics operating expenses, the focus on the DSD channel as a final frontier to gain efficiency will come under increasing scrutiny. The redundancy of having DSD distribution networks in addition to centralized distribution networks will become exposed and leading retailers will start to put more pressure to opt out of inefficient DSD channels. The process of channel switching will not be without a tough challenge as there are many built-in barriers that complicate matters. For example, many suppliers of DSD products do not fully own their DSD distribution networks. As such, they cannot convert distribution approaches without buy-in from the independent distributors, which may number in the dozens, and will be very resistant to change.

One thing is for sure; you can expect to hear much more on this topic as the cost of transportation rises and retailers continue to seek ways to take costs out of the system.

1 小时前