2017年美国仓库作业调查报告

2017 Warehouse/DC Operations Survey:

BY ROBERTO MICHEL,EDITOR AT LARGE

As e-commerce fulfillment pressure continues to climb,our annual survey points to the many changes taking hold—from more investment in automated approaches to piece picking, more use of robotics, increased interest in throughput metrics and general process improvement.

During the adaptation of industry trends, there comes a point when you pass the early stages of adjustment and dive into really doing things differently. Our “2017 Warehouse and Distribution Center (DC) Operations Survey” shows us an industry that’s now in the midst of that change—and we’re getting into the thick of e-commerce adjustments.

The tweaks include more investments in automated order picking, voicedirected systems and other technology. We’re also seeing pain points continue to swell; foremost among these is the struggle to find qualified workers. Also emerging are data that suggest respondents may be reshaping their DC networks with smaller facilities to serve as fulfilment centers closer to the point of demand.

The survey, conducted annually by Peerless Research Group (PRG), drew more than 300 responses this year from professionals in logistics and warehouse operations management across multiple verticals. One of the clearest data points, and the issue that is likely driving change of many types, is the level of e-commerce involvement, according to Don Derewecki, a senior consultant with St. Onge Company, and Norm Saenz, Jr., a managing director with St. Onge, a supply chain engineering consulting company and partner for this annual survey.

In fact, 19% of respondents now say they do omni-channel fulfillment, up 3% from last year, while 37% say they do e-commerce, up by 2% from last year. This steady growth in e-commerce and all the pressures that brings around piece picking, labor management and cycles times, is driving deep change for respondents, says Derewecki.

“Overall what we are seeing and what seems to be consistent with the study results is that there is more of requirement for speed and accuracy, driven very much by e-commerce expectations,”says Derewecki.

In response, the survey shows some technologies that had been flat the last few years are on the increase this year. Many of these are involved in the each picking that is a hallmark of e-commerce fulfillment, says Saenz. “The investments are increasing a bit more for certain areas like voice, pick to light, and put walls, which points to operators applying some technology toe-commerce pressures,” says Saenz.

The annual survey of decision makers for warehouse/DC operations spans multiple areas, including facility, labor and other operations trends, use of technology, capital expenditure levels, and use of metrics.

We also ask about disruptions from natural disasters, and with the disastrous hurricane season of 2017 fresh on people’s minds, the response for this question jumped, with 15% saying they had experienced a catastrophic event, up from just 6% in 2016.Most participating companies came from manufacturing (46%), followed by distributors (27%), third-party logistics providers (11%) and retailers (6%).

Leading verticals included food and grocery, automotive and aerospace, general merchandise, electronics, fabricated metals, and paper products.

Operations snapshot

In recent years, the survey has trended toward “more” as the norm when It comes to factors like facility clear heights and labor forces. This year’s survey results, however, has some data that runs contrary to these recent trends, but is consistent on others like the nature of inbound and outbound shipments, as well as the steady march of e-commerce.

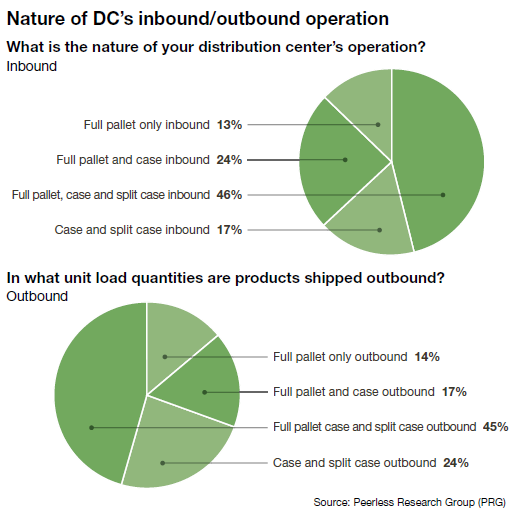

For 2017, 14% of respondents handle full pallets on the outbound side, up from9% last year. On the inbound side, full pallet was only at 13%, which is the same as last year. On the outbound side, 45%handle full pallet case and split case, while24% handle case and split case, for a total of 69% for those two answers, the same as last year. Thus, while the response for outbound“full pallet only” grew slightly, the outbound profile is relatively consistent.

Wholesale (67%) and retail (58%)remain the most common channels serviced, with wholesale staying equal to the previous year’s 67%, and the response for retail down by 2%. This year, 37% say that they service an e-commerce channel, up from 35% in 2016. Additionally,19% say they have an omni-channel service environment, up from 16% last year.

While there is likely some overlap on these answers, 56% now say they service omni-channel or e-commerce needs. How channels are being fulfilled—in terms of using third-partly logistics(3PL) sites, servicing channels in-house(self-distributed) from one DC, or self-distributed with separate DCs for different channels—also experienced some change. Those saying they selfdistribute for all channels from one DC fell from 42% last year to 37% for 2017, while 30% now say they self-distribute with separate DCs for different channels, up from 24% in 2016.

The survey’s findings on inventory were slightly different from the previous year. The average number of SKUs declined to 13,130this year from 13,774 the previous year. The percentage of SKUs that are conveyable or can be handled robotically was 29%, down from 36% the year previous. Annual inventory turns for 2017 came in at 8.5 turns, a decline from 9.2 turns the year previous.

While more turns is typically desirable, a couple of factors may play into the slower movement. One, says Dere wecki, is the cost of financing remains low, so there is less cost involved in carrying more inventory. The widening of the Panama Canal and enhancements to some U.S. ports also has tended to increase the volume of cargo that can be imported at an attractive cost, adds Derewecki. Respondents are after better, tighter inventory control. When asked about actions taken to lower operating costs,“improving inventory control” was the second most common answer, with a 63% affirmative response, up from 60%the previous year.

DCs and labor forces

The trend toward “bigger, taller and more” when it comes to facilities and labor altered slightly for the 2017survey. When asked about most common square footage for buildings in the DC network, the average for 2017 was193,190 square feet, down slightly from199,040 square feet last year. Average clear height of buildings was29.8 feet for 2017, down from 31.1 feet in 2016, and 30.8 feet the year previous. However, 27% of respondents said clear height ranged from 30 feet to 39 feet, up 1% from 2016. Total square footage in the network averaged 473,400 square feet, down from 539,00. The median dropped as well, from 240,410 to176,600, while the “mega-sized” DC network response (2 million square feet or more) stayed at 10%. Why the shift in facility and DC network sizes? There is natural variation year to year due to different sets of respondents. Another factor at play may be the growth of e-commerce, says Saenz.

With industrial real estate availability tight, and a growing need to service e-commerce orders quickly, it may be that some operators are opening relatively smaller fulfi¬llment centers versus big DCs that service traditional channels and large regions. “I think e-commerce is really starting to drive some of the survey results we’re seeing, even in areas like clear heights or smaller facilities,” says Saenz. “Buildings last a long time, so some smaller facilities built decades ago may be getting repurposed as ful¬fillment centers for ecommerce. Also, I think the growth in ecommerce volume has pushed the need to have the inventory and processes setup in a separate building.

As a result, some of the ¬ findings that at ¬ first glance seem confusing start to make sense once you realize that e-commerce growth is driving various changes. ”When asked about DC expansion plans, 23% said they plan to expand square footage, down slightly from 27%last year. However, 17% say they plan to expand the number of buildings, up 3%from 2016. Employee/labor expansion plans also are on the rise. Over the next 12 months, 36% see expansion in the number of employees, up from 33%last year.

Solutions and metrics

The types of technology investments respondents are interested in generally align with the pressures of e-commerce order picking and ful¬fillment. For instance,10% indicated that they use some form of automated order picking, up from3% from last year and the 7% from 2015.

Among speci¬fic picking technologies,12% say they are using a “parts-to-person” system, up from 10% in 2016. Voice assisted solutions with no scanning came in 7%, up from 3%, while voice with scan veri¬fication was also 7%, down 1%from the previous year.

Robotic or other automated technology was in use by 5% of respondents, up from 3% last year. Use of automated storage and retrieval systems was up by 1%, while automated guided vehicle use grew from 3% to 6%.When it comes to “order ¬ filling” techniques, 20% use a “put” to order method, up from 15% in 2016. Use of put walls grew by 2%.

Use of warehouse management systems(WMS), from various types of vendors as well as legacy/homegrown, grew from 83% across all types last year to87% this year. Best-of-breed WMS grews lightly from 11% to 13%, but somewhat surprisingly, so did the response for use of legacy systems, up by 7%. While it’s possible that packaged solutions from enterprise resource planning(ERP) and WMS vendors have been around so long that some consider older packaged solutions as legacy, the overall trend is that WMS is in use at the vast majority of respondent locations.

In keeping with that use level,60% of respondents say their primary data collection method to gauge productivity is “automated through a WMS, ”up from 59% last year. Manual data collection methods are used by 55% of respondents, down from 57% last year. Overall, the technology portion of the survey reflects that operators are layering in more automation, though not necessarily big ticket, fixed automation.

全部 0条评论