2018 Warehouse/Distribution Center Equipment Survey

2018 Warehouse/Distribution Center Equipment Survey

— Automation & Robotics Lead Robust Outlook

关键点:

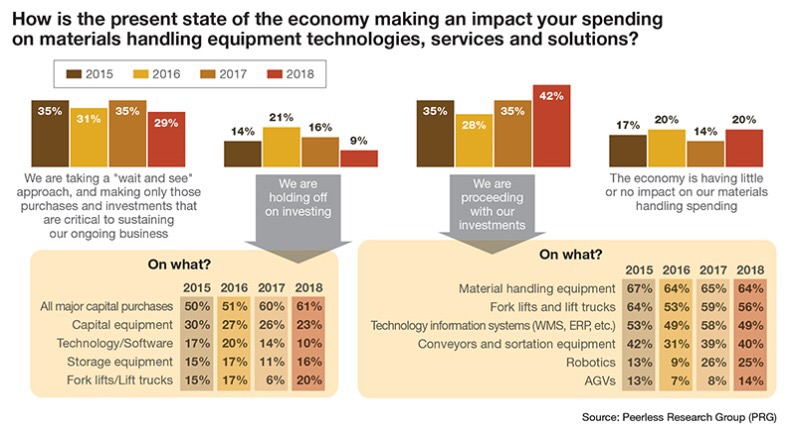

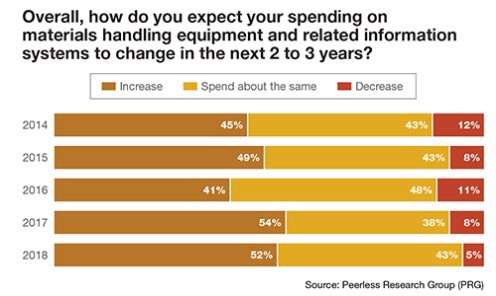

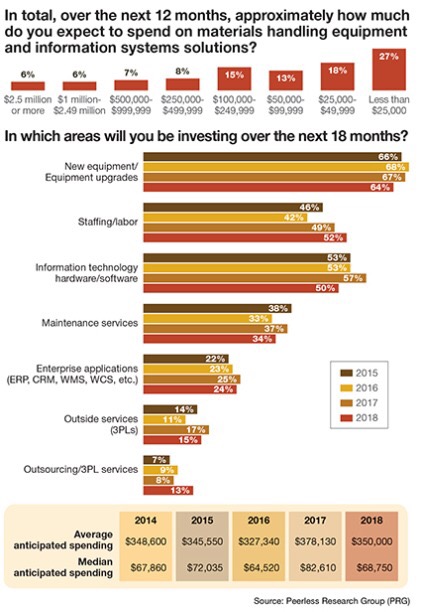

- 设备投资前景将是乐观的。受访者表示他们正在“进行投资”的比例达到了四年来的最高水平。

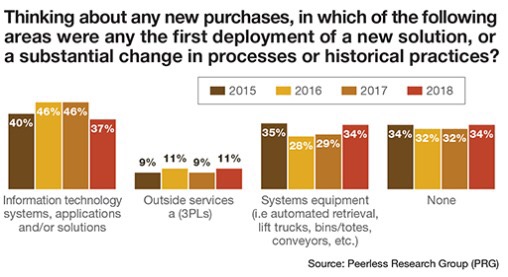

- 人们越来越关注使用相对较新的技术,包括机器人,无人驾驶飞机和智能眼镜。

- 平均拥有131,2675平方英尺的DC空间。受访者平均分布在多个行业,其中最常见的是食品和饮料,工业机械,零售贸易,电子产品,

- 表现强劲增长的类别包括自动化存储和检索(AS / RS)系统,仓库控制系统(WCS)软件和仓库执行系统(WES)软件以及机器人等紧密相关类别。

全部 0条评论